You don't need

it anymore

You need cash

more than coverage

You can't afford

it any longer

Your life insurance policy is a financial asset… And it can be sold for cash!

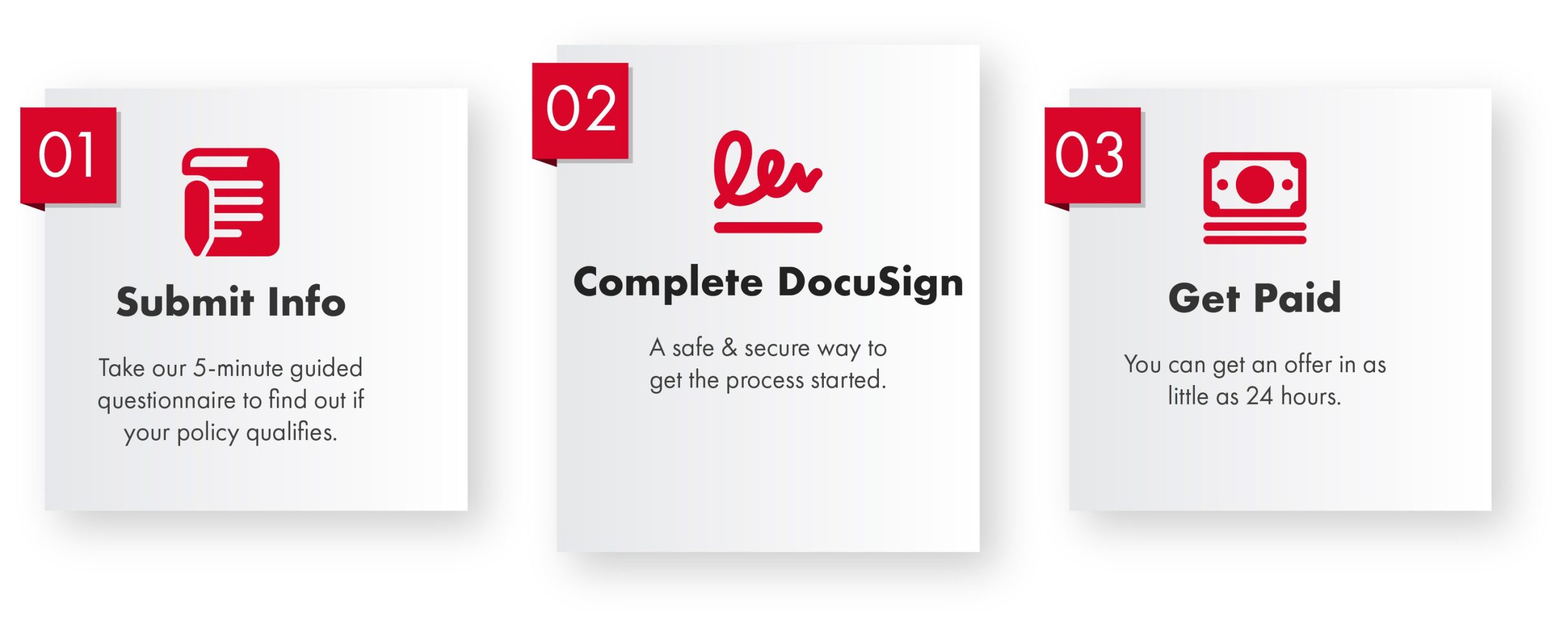

Our mission is to make the process of selling your life insurance policy as easy and fast as possible. Simply submit your policy for a free evaluation, sign one document to get started, and you could be on your way. It really is that easy.

Insured’s age: 84

Insured’s age: 68

Insured’s age: 77 & 73

The most important factors to consider are the insured’s age and health and the specifics of the policy, such as type, size, and ongoing costs.

Unless there are major health conditions, the minimum age to qualify is usually about 60. If there are serious medical conditions present, age is no longer a factor and it comes down to policy specifics and the severity of the disease.

It’s very rare for a policy smaller than $100,000 to qualify, though we wouldn’t say it’s impossible. A combination of smaller policies, such as two $50,000 policies, will sometimes work to meet the minimum size requirement.

Life insurance is a great financial tool for protecting your family. But as you grow older and those needs change, it may not make sense to maintain your policy any longer. Rather than lapsing or surrendering it back to the carrier, you can sell a life insurance policy for cash. Consider selling for the following reason:

Your kids are grown and financially independent, you’ve outlived your beneficiary, you’ve sold your home or business . . . whatever the reason, you can sell your policy.

Selling your policy means you get a lump-sum cash payment and no longer have to pay premiums. It’s a win-win!

Unexpected medical expenses, you’d rather spend your money on experiences, you need to move into assisted living . . . the reasons are vast.

Our mission is simple: to make selling your life insurance policy as easy and fast as possible. Everything we do is meant to get us closer to that goal, and we hope that you feel that passion and sense of purpose when you talk with us.

Backed by a team of experts with more than 20 years’ experience in helping people sell their policies, we’re here to provide best-in-class service and an experience you’ll want to tell your neighbor about.

Give us a chance to show you why Sell Easy is the best option when it comes to selling your life insurance.